|

From King Henry IV of France, to the election of President Herbert Hoover in 1928, kings and politicians have been credited with promising "a chicken in every pot," though it was generally their government's own policies, which kept that from being possible.

As with most elections since We the People lost control of our government here in the United States, this election in 2014 is about the economy. Just like economic woes of the past, they are due to the actions of those same characters now running on promises to fix it, in my humble opinion, while all that is necessary for our nation to once again flourish is for those same politicians and their bureaucratic minions to follow the ultimate law of the land...our Constitution. How so? Simple. Our federal government, by Constitution, was given three main sources for federal revenue: 1) import duties, 2) imposts, and 3) excise taxes on luxury items. Any residual funds needed for operations at the federal level were allocated to the States based on the number of citizens residing in each of them, which is why we have a census every ten years. Import duties sustained our nation throughout the years of its greatest growth as a manufacturing nation, and until 1928, America had the highest duty rate of all its trading partners while concurrently outstripping them all in industrial growth during those same decades. The argument that import duties hurt the economy does not stand scrutiny. Throughout modern history, no nation has ever free-traded its way to prosperity. Free trade benefits only the free traders, and no nation has ever gone that economic route until it was either the dominate force in trade already, or forced other nations to follow the course by its mandate from that dominate trading partner. Without protective duties, it would not have been possible for the United States to flourish as it once did. Without protective duties being put back in place, it is doubtful this country will reach such a level of prosperity again. Want a chicken in every pot? Restore constitutional funding of the U.S. government through import duties. That solves two problems at one time. 1) Every industry in America would immediately seek domestic production of its goods, as it would once again be viable to manufacture its products at home. How so? The import duty would offset the advantages of producing abroad, and could be adjusted to compensate for any artificial subsidies given those industries by foreign nations. Manufacturing in America would boom overnight. 2) If the U.S. government had to rely principally upon revenues from imports rather than an income tax (which was precluded by the U.S. Constitution in Section 8 of Article I as illegal), then we would have a much more limited federal government. Its income could not be artificially inflated by seizures of citizens' cash as is done under the constitutionally unlawful income tax. The results? 1) Every American who wanted a job would have one and 2) government would be forced to live within its economic means, or face extraordinary pressure from the States for overspending. History, including our own, has proven this model to assure economic viability of domestic industries. It once worked for us, and can again. Want a chicken in every pot and every household to have jobs? Go back to the United States Constitution. It truly is as simple as that. Reimpose import duties on goods from other nations, and put federal government back on its leash. Go back to what worked. Viva la devolution. Howell Woltz

0 Comments

Leave a Reply. |

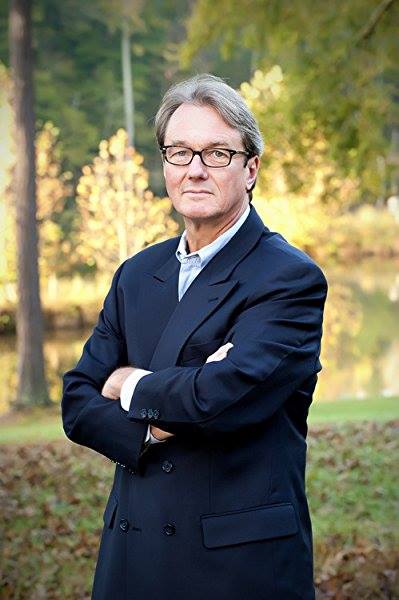

AuthorBorn in North Carolina and educated at the University of Virginia, Wake Forest University and Caledonian University in Scotland, Howell now lives in Warsaw, Poland with his wife, Dr. Magdalena Iwaniec-Woltz. Howell is the European Correspondent for The Richardson Post and Chairman of The International Centre for Justice. Archives

December 2019

Categories

All

|

RSS Feed

RSS Feed